Unlock Exclusive Perks With a Federal Credit Scores Union

Federal Credit score Unions offer a host of special advantages that can considerably influence your financial wellness. From enhanced financial savings and examining accounts to lower interest rates on car loans and individualized financial planning services, the benefits are tailored to help you save money and accomplish your economic objectives much more efficiently. However there's even more to these benefits than just financial benefits; they can also provide a sense of protection and neighborhood that goes beyond traditional financial services. As we explore additionally, you'll uncover how these special benefits can really make a distinction in your monetary trip.

Subscription Eligibility Criteria

To end up being a participant of a government lending institution, individuals must satisfy particular qualification criteria established by the organization. These standards vary relying on the specific debt union, yet they usually consist of factors such as geographical location, employment in a certain market or business, subscription in a specific organization or association, or family members connections to present members. Federal debt unions are member-owned economic cooperatives, so qualification needs are in area to make sure that people that join share an usual bond or association.

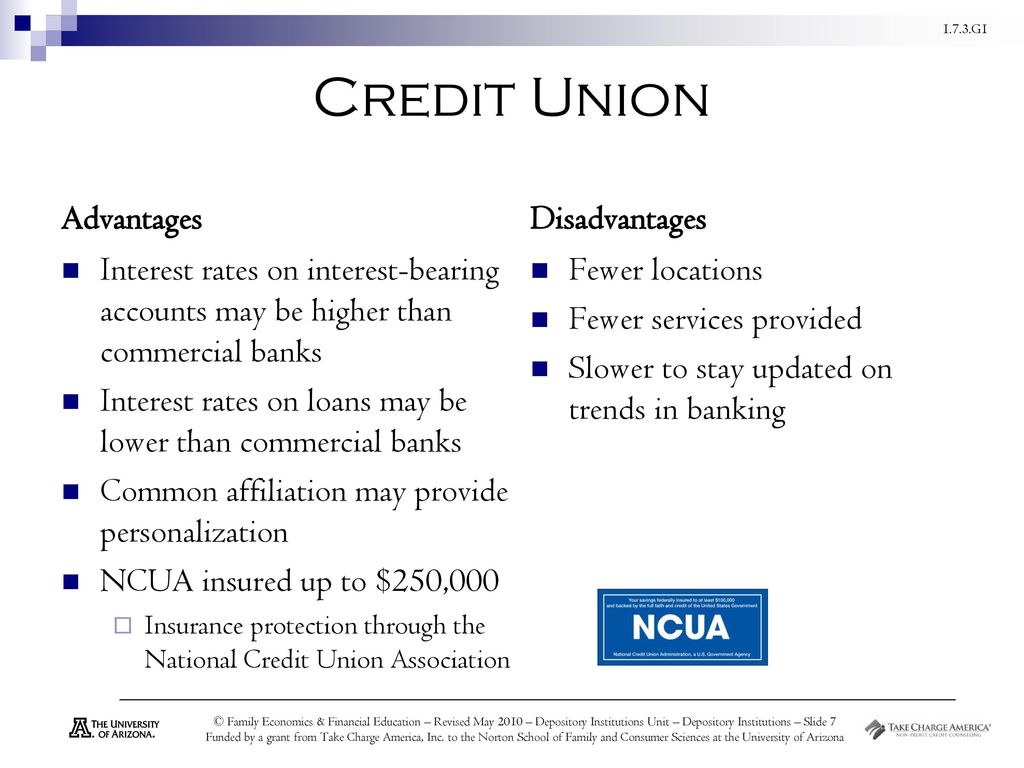

Enhanced Financial Savings and Inspecting Accounts

With boosted cost savings and examining accounts, federal credit report unions use members premium monetary items developed to maximize their finance methods. These accounts commonly come with higher rates of interest on financial savings, lower costs, and fringe benefits compared to standard financial institutions. Participants can delight in attributes such as competitive returns rates on financial savings accounts, which assist their cash expand faster with time. Examining accounts might provide perks like no minimum equilibrium requirements, totally free checks, and atm machine fee repayments. Additionally, federal credit history unions commonly give online and mobile banking services that make it convenient for participants to monitor their accounts, transfer funds, and pay expenses anytime, anywhere. By utilizing these enhanced savings and checking accounts, members can maximize their cost savings prospective and efficiently manage their daily funds. This focus on offering premium economic items establishes government cooperative credit union apart and demonstrates their commitment to helping members attain their economic goals.

Reduced Rates Of Interest on Car Loans

Federal cooperative credit union offer members with why not look here the advantage of lower passion prices on finances, allowing them to obtain money at more economical terms compared to other economic establishments. This advantage can cause substantial savings over the life of a lending. Lower rates of interest imply that consumers pay less in interest costs, decreasing the general price of borrowing. Whether participants need a loan for a car, home, or personal expenses, accessing funds via a government cooperative credit union can result in more desirable repayment terms.

Personalized Financial Planning Services

Offered the emphasis on improving participants' financial wellness via lower interest rates on finances, government credit history unions also supply individualized monetary preparation services to aid individuals in accomplishing their long-term monetary objectives. By examining revenue, expenses, liabilities, and possessions, government credit union economic planners can assist members produce a comprehensive economic roadmap.

Moreover, the visit here tailored monetary planning solutions supplied by federal credit unions frequently come with a reduced cost contrasted to personal economic advisors, making them more accessible to a bigger series of people. Participants can gain from expert assistance and know-how without incurring high charges, straightening with the credit union approach of focusing on participants' financial health. Overall, these solutions aim to empower members to make informed economic choices, construct wealth, and secure their monetary futures.

Access to Exclusive Member Discounts

Participants of federal lending institution enjoy exclusive accessibility to a range of member price cuts on various product or services. Wyoming Federal Credit Union. These price cuts are a useful perk that can aid members save money on daily expenses and unique acquisitions. Federal cooperative credit union usually partner with retailers, provider, and various other businesses to offer discounts specifically to their participants

Members can benefit from price cuts on a variety of items, consisting of electronic devices, apparel, traveling bundles, and extra. In addition, solutions such as cars and truck leasings, resort bookings, and enjoyment tickets might additionally be readily available at discounted prices for lending institution participants. These exclusive price cuts can make a considerable difference in members' budget plans, allowing them to appreciate cost savings on both crucial products and deluxes.

Verdict

To conclude, signing up with a Federal Lending institution provides numerous advantages, consisting of enhanced savings and checking accounts, reduced passion rates on finances, individualized financial planning services, and accessibility to unique member discount rates. By ending up being a member, people can gain from a series of economic benefits and services that can assist them conserve money, plan for the future, and reinforce their connections to the regional community.

Joseph Mazzello Then & Now!

Joseph Mazzello Then & Now! Michael J. Fox Then & Now!

Michael J. Fox Then & Now! Earvin Johnson III Then & Now!

Earvin Johnson III Then & Now! Batista Then & Now!

Batista Then & Now! Tonya Harding Then & Now!

Tonya Harding Then & Now!